Your Financial GPS

A budget isn't about restriction; it's about permission. It's a plan that ensures you direct your money toward your goals instead of wondering where it went.

⚖️ 1. Needs vs. Wants

Concept: Needs are essentials (rent, food). Wants are nice-to-haves (dining out).

Action: Label every expense to see where your money really goes.

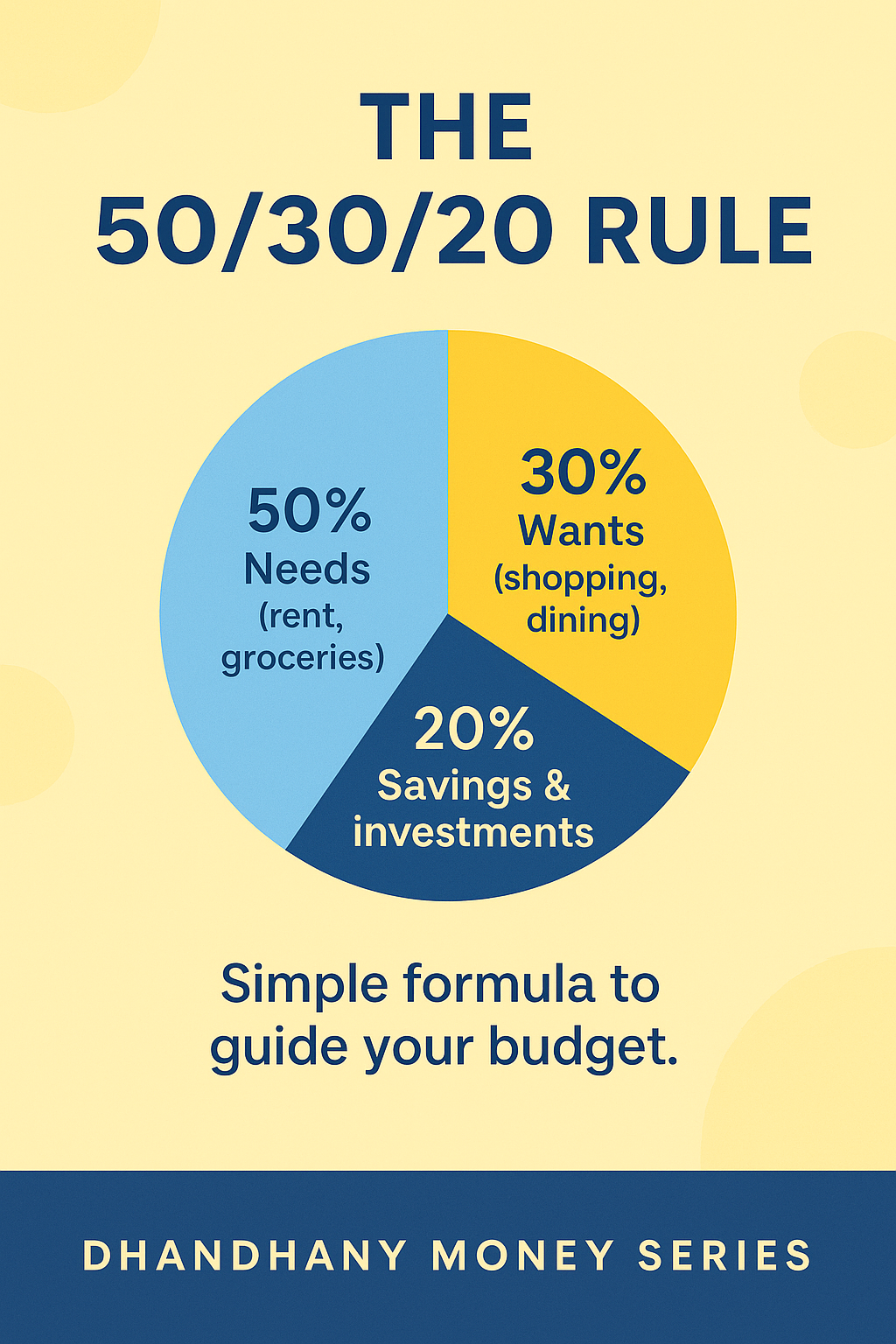

🍰 2. The 50/30/20 Rule

Rule: 50% Needs, 30% Wants, 20% Savings/Debt Repayment.

Action: Use this as a starting benchmark to balance your life.

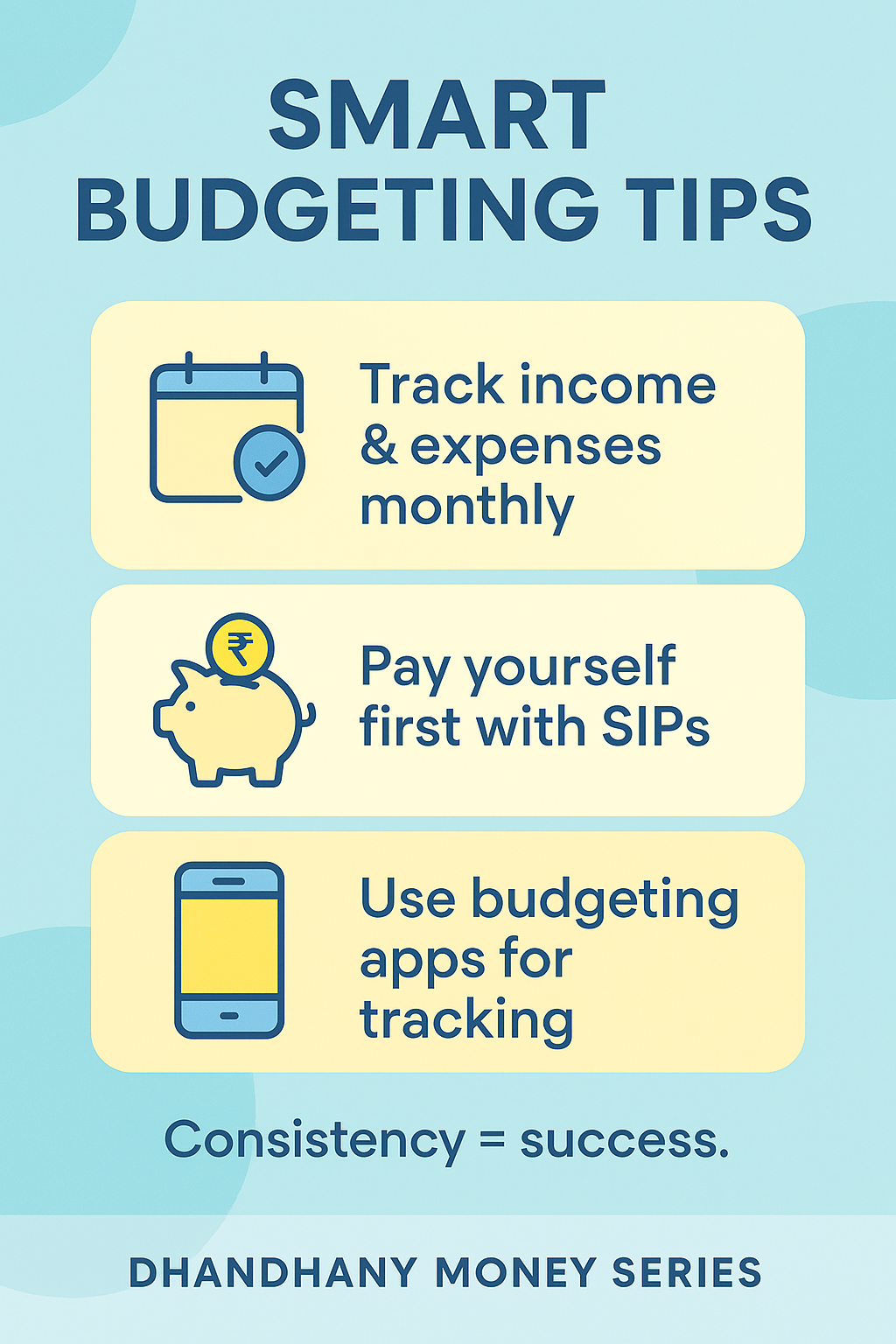

📱 3. Tracking Tools

Concept: You can't manage what you don't measure.

Action: Use an app, Excel sheet, or a simple notebook. Just start.

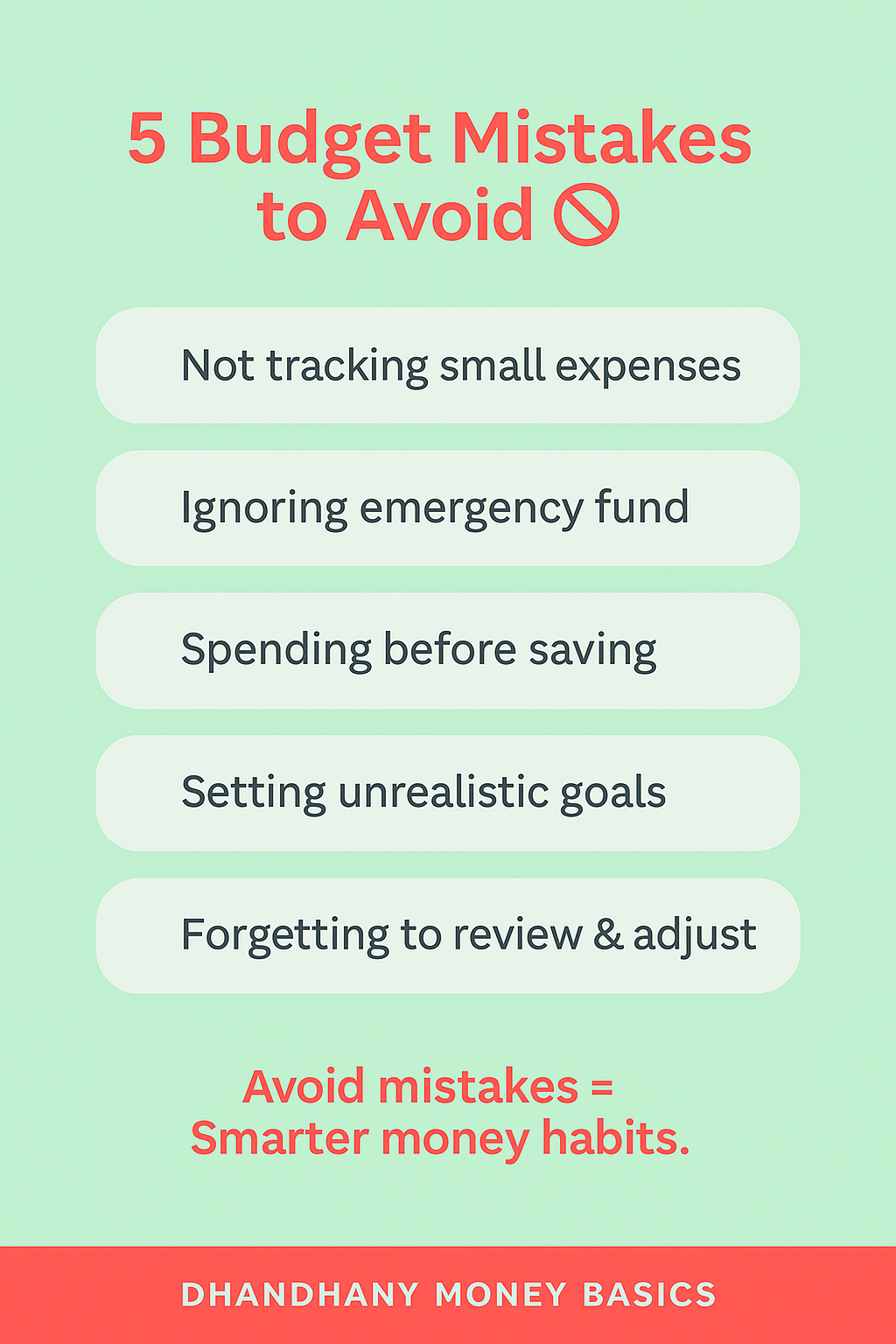

🔄 4. Review & Adjust

Concept: A budget is a living document, not set in stone.

Action: Check in weekly. Adjust categories if you overspend in one area.

Explainer Video

Watch: How to start budgeting in 5 mins.

Give Every Rupee a Job

Zero-Based Budgeting (ZBB) is a method where your Income minus Expenses equals Zero. Every rupee gets assigned a specific purpose.

0️⃣ 1. The Principle

Formula: Income - Expenses = 0. No money is left "floating".

Goal: Assign every rupee to bills, savings, or fun BEFORE the month starts.

🎯 2. Intentionality

Why it works: It forces you to be intentional. You can spend guilt-free because it's planned.

Benefit: Stops "mystery spending" where money disappears.

⚡ 3. Handling Variables

Challenge: Income or bills fluctuate.

Solution: Use last month's average for variable bills. Adjust mid-month if needed.

🏦 4. The "Sinking Fund"

Concept: Save small amounts monthly for big annual bills (like insurance).

Benefit: Avoids panic when a large annual payment is due.

Explainer Video

Watch: Master your money with Zero-Based Budgeting.

Your Financial Safety Net

Life is unpredictable. An emergency fund is money set aside specifically for life’s unexpected events so you don't have to borrow to survive.

🛡️ 1. What is it?

Definition: A cash reserve for unplanned expenses.

Examples: Job loss, medical emergency, sudden car repair.

💰 2. How Much?

Rule of Thumb: 3 to 6 months of essential living expenses.

Calculation: (Rent + Food + Bills + EMI) x 6.

📍 3. Where to Keep It?

Criteria: Must be safe and instantly accessible (liquid).

Best Options: Savings Account or Liquid Mutual Funds.

🚫 4. What it is NOT for

Not for: Buying a new phone, vacations, or investments.

Discipline: Only touch it when it's a true emergency.

Infographic

Explainer Video

Watch: Why you need an Emergency Fund ASAP.

Know Your Financial Personality

We are all wired differently. Understanding if you are a Saver or a Spender helps you build habits that stick.

🐿️ 1. The Saver

Traits: Loves security, hates waste, gets a high from seeing balances grow.

Challenge: Can be too fearful to enjoy life or invest for growth.

🛍️ 2. The Spender

Traits: Loves experiences, generous, sees money as a tool for enjoyment.

Challenge: Often lacks an emergency fund and prone to impulse buys.

⚖️ 3. Finding Balance

For Savers: Create a "Fun Budget" you MUST spend.

For Spenders: Automate savings so money is gone before you see it.

👫 4. Managing Big Expenses

Concept: Big Expenses are often attractive.

Action: Set a "discussion limit"—any purchase over ₹5,000 needs a chat.

Explainer Video

Watch: Why you spend the way you do.

A Real Story of Change

Meet Maya, who went from living paycheck-to-paycheck to building real wealth using these budgeting principles.

🌧️ 1. The Struggle

Situation: Irregular income, ₹50k credit card debt, no savings.

Feeling: Anxious every time the rent was due.

🛑 2. The Wake-Up Call

Trigger: Her laptop broke, and she had no money to fix it.

Action: Started tracking expenses that very night.

📉 3. The Method

Strategy: Used the 50/30/20 rule. Cut dining out by 50%.

Key Move: Created an "Emergency Fund" for future emergencies.

🎉 4. The Result

Outcome: Debt-free in 18 months. 3 months of expenses saved.

Now: Investing for her first home.

Explainer Video

Watch: How Maya cleared her debt.